A number of UK property funds, including Henderson and M&G, have adjusted the prices of their UK Property Funds reflecting that more money has been leaving the funds than is being subscribed by new investors. All unit trusts do this at times but the effect is more pronounced for Property Funds due to the greater costs associated with transactions in commercial property.

When cashflows into a fund are positive, even a single-priced fund will price its portfolio on an ‘offer’ basis meaning new investors pay the associated costs and those who are selling benefit. When cashflows are negative, the pricing basis can “swing” to a ‘bid’ basis – meaning those selling their units effectively pay the transaction costs that may be required to dispose of some underlying assets. This is intended to stem redemptions.

In the case of the Henderson Fund, for example this has been on an offer basis since Autumn 2012 and has now reverted to the bid basis, meaning the price of the fund has reduced by 5%.

It is important to note that there is no change in the valuation of the underlying assets themselves as this pricing mechanism is designed to ensure that investors exiting the fund pay the associated potential transaction costs with dealing in property.

The price could return to an offer basis in the future, in which case the price would increase by a similar amount but it is not possible to know in advance when this might occur.

Our View It seems likely this issue has arisen now due to some investors jockeying for position in advance of the EU Referendum and reducing exposure to UK-domiciled assets. However, we do not believe that this marks the end of the road for the asset class in this cycle. Based on the outlook for UK economic growth and the relative attractiveness of the yield on property compared with cash and Gilts, we anticipate remaining long term investors in UK commercial property.

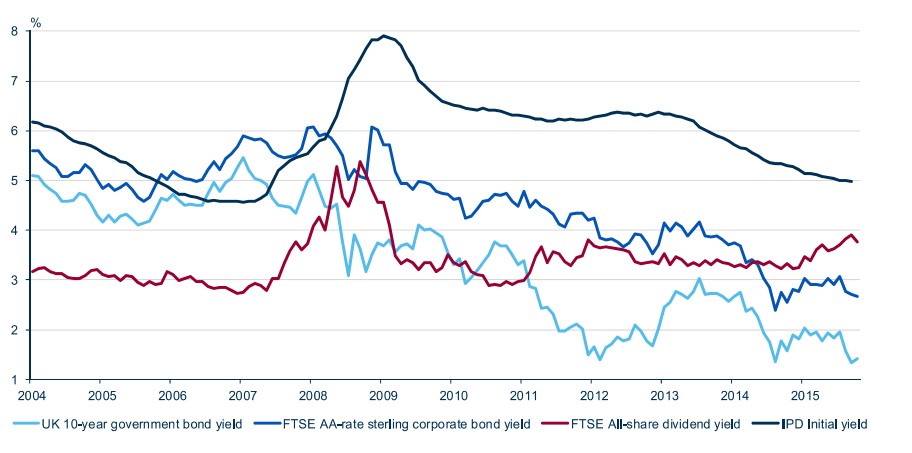

As can be seen from the chart, which compares the yields on UK Gilts, Corporate Bonds, Shares and Property, the last downturn in Commercial Property (2007) was preceded by Gilt yields (light blue) exceeding the yield on Property (navy blue). At current values there remains a wide gap between the two, suggesting a reward for investors prepared to hold the asset class; and so it would take a major rise in Gilt yields for a repetition of 2007 to occur – we do not share the view of Messrs Osborne and Cameron that Gilt yields would jump on a ‘Leave’ vote.

UK asset class yields – source: Standard Life Investments

Risk Warnings

- Past performance is no guarantee of future returns.

- The price of units and the income from them can fall as well as rise.

- The value of an investment is not guaranteed and you may not get back the full amount invested.

- Some investments, e.g. property, may not be readily realisable, and will be subject to market conditions at that time.